Property Transfer Tax

I'm interested in

Property Transfer Tax

What do I need to know about

British Columbia's Exemptions?

BC's UPDATED RULES

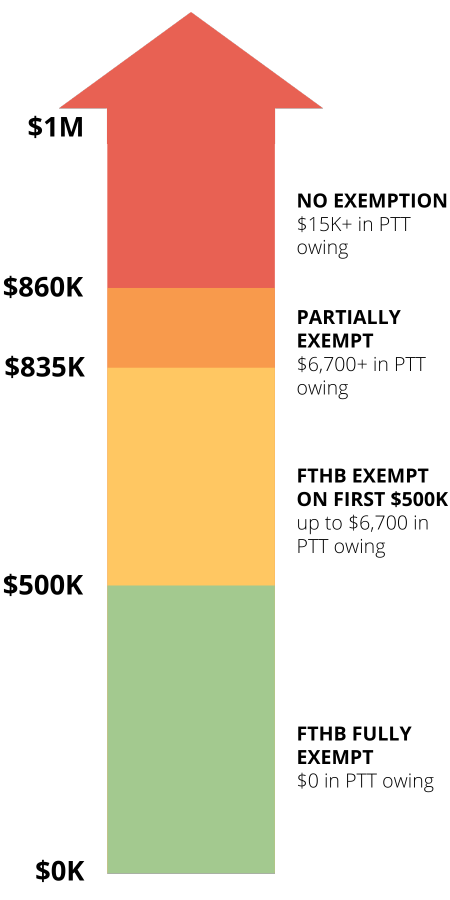

Previously, First Time Home Buyers (FTHBs) in BC qualified for a Property Transfer Tax (PTT) exemption up to a purchase price of $500,000 and were partially exempt on a sliding scale up to a purchase price of $525,000. PTT was fully payable on a purchase price higher than this.

Now, as of April 1, 2024, FTHBs will qualify for:

- A purchase price up to $500,000, a full PTT exemption.

- A purchase price between $500,000 - $835,000, an exemption of PTT on the first $500,000. 2% PTT will be payable on the remaining balance between $500,000 and $835,000.

- A purchase price between $835,000 - $860,000, there will be a reduction of the PTT exemption in the amount of $320.80 for each $1,000 between $835k and $860k.

EXAMPLE

For a purchase price of $800,000, as a FTHB:

Prior to April 1, 2024, the full PTT would be payable, $14,000

After April 1, 2024, the first $500,000 is exempt. PTT is payable on the remaining balance, $300,000, for a total of $6,000, meaning a savings of $8,000 in this case for FTHBs.

KEYS TO QUALIFY

Only applicable to FTHBs

- Must be a Canadian Citizen or a Permanent Resident

- Must have lived in BC for at least a year prior to the date of property registration OR filed at least two income tax returns as a BC resident in the last six taxation years

- Have never owned a property anywhere in the world at any time

- There are other ways to potentially qualify for a PTT Exemption listed HERE

SLIDING SCALE

BC's UPDATED RULES

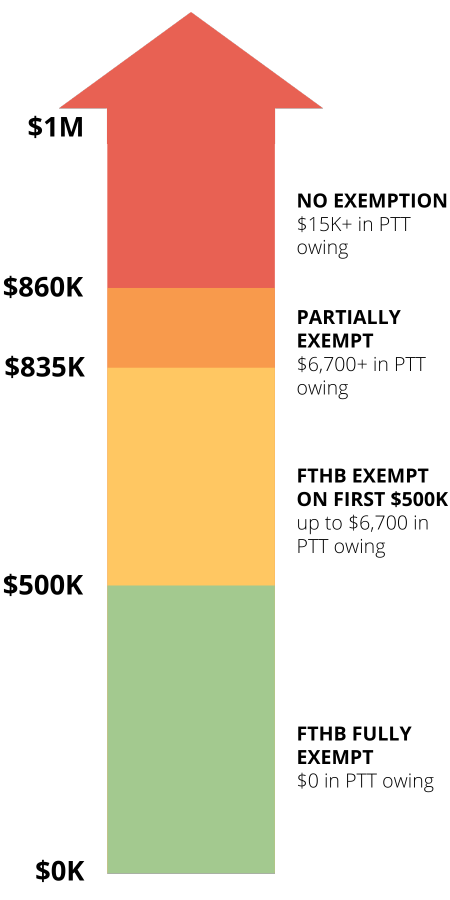

Previously, First Time Home Buyers (FTHBs) in BC qualified for a Property Transfer Tax (PTT) exemption up to a purchase price of $500,000 and were partially exempt on a sliding scale up to a purchase price of $525,000. PTT was fully payable on a purchase price higher than this.

Now, as of April 1, 2024, FTHBs will qualify for:

- A purchase price up to $500,000, a full PTT exemption.

- A purchase price between $500,000 - $835,000, an exemption of PTT on the first $500,000. 2% PTT will be payable on the remaining balance between $500,000 and $835,000.

- A purchase price between $835,000 - $860,000, there will be a reduction of the PTT exemption in the amount of $320.80 for each $1,000 between $835k and $860k.

KEYS TO QUALIFY

Only applicable to FTHBs

- Must be a Canadian Citizen or a Permanent Resident

- Must have lived in BC for at least a year prior to the date of property registration OR filed at least two income tax returns as a BC resident in the last six taxation years

- Have never owned a property anywhere in the world at any time

- There are other ways to potentially qualify for a PTT Exemption listed HERE

EXAMPLE

For a purchase price of $800,000, as a FTHB:

Prior to April 1, 2024, the full PTT would be payable, $14,000

After April 1, 2024, the first $500,000 is exempt. PTT is payable on the remaining balance, $300,000, for a total of $6,000, meaning a savings of $8,000 in this case for FTHBs.

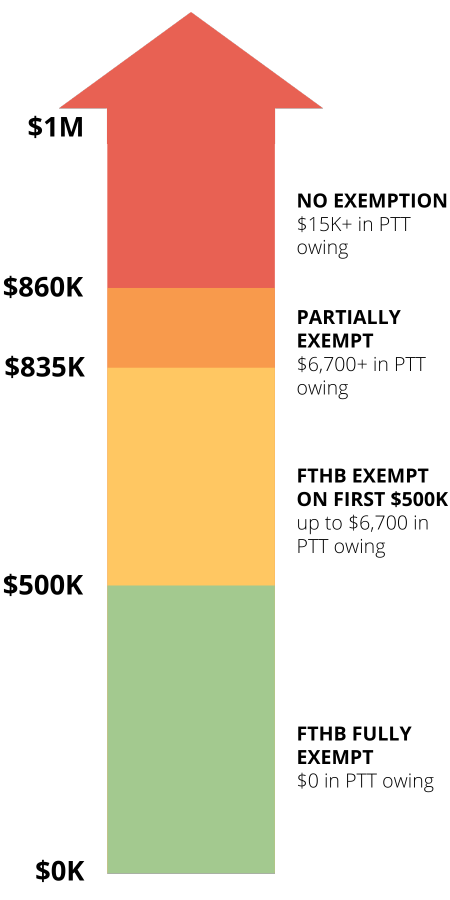

BC's UPDATED RULES

Previously, First Time Home Buyers (FTHBs) in BC qualified for a Property Transfer Tax (PTT) exemption up to a purchase price of $500,000 and were partially exempt on a sliding scale up to a purchase price of $525,000. PTT was fully payable on a purchase price higher than this.

Now, as of April 1, 2024, FTHBs will qualify for:

- A purchase price up to $500,000, a full PTT exemption.

- A purchase price between $500,000 - $835,000, an exemption of PTT on the first $500,000. 2% PTT will be payable on the remaining balance between $500,000 and $835,000.

- A purchase price between $835,000 - $860,000, there will be a reduction of the PTT exemption in the amount of $320.80 for each $1,000 between $835k and $860k.

EXAMPLE

For a purchase price of $800,000, as a FTHB:

Prior to April 1, 2024, the full PTT would be payable, $14,000

After April 1, 2024, the first $500,000 is exempt. PTT is payable on the remaining balance, $300,000, for a total of $6,000, meaning a savings of $8,000 in this case for FTHBs.

KEYS TO QUALIFY

Only applicable to FTHBs

- Must be a Canadian Citizen or a Permanent Resident

- Must have lived in BC for at least a year prior to the date of property registration OR filed at least two income tax returns as a BC resident in the last six taxation years

- Have never owned a property anywhere in the world at any time

- There are other ways to potentially qualify for a PTT Exemption listed HERE