Credit Scores

What is a

Credit Score

What do I need to know about

how they are calculated?

WHAT IS A CREDIT SCORE?

A credit score is a three digit number designed to predict the likelihood that an individual will pay their bills as agreed upon. It is a tool available for financial institutions to determine your creditworthiness. In Canada, there are two companies that provide credit adjudication, Equifax & TransUnion.

Consumer facing scores and lender facing scores are often different as they are taking into consideration different modeling data. Don't be surprised if they vary.

CAN I FIX MY SCORE IF IT IS LOW?

There are many things one can do to help improve their credit score:

- If there are errors on your report, we can assist with having them investigated and revised.

- Ensure all payments are up to date and made in full.

- Ensure all revolving credit is below 75% of the limit.

- If there are substantial credit concerns, we have partners who specialize in fixing & strengthening credit.

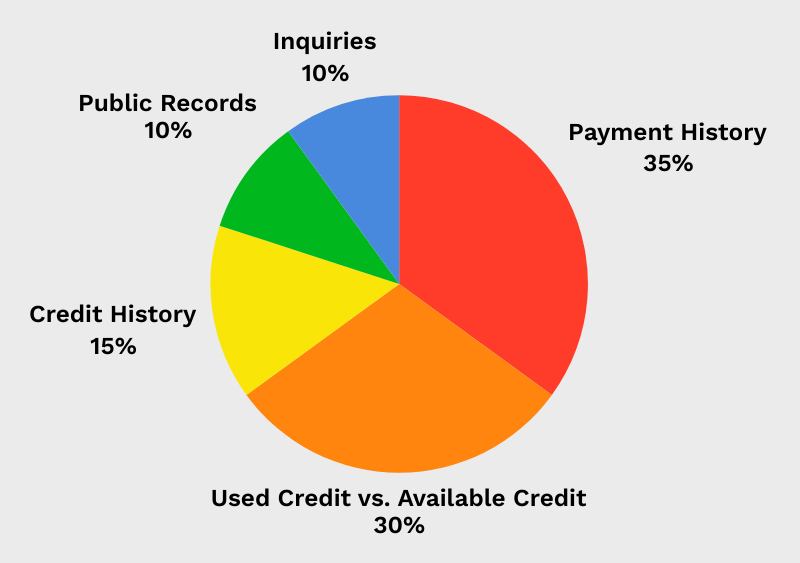

WHAT FACTORS ARE INVOLVED IN CALCULATING A CREDIT SCORE?

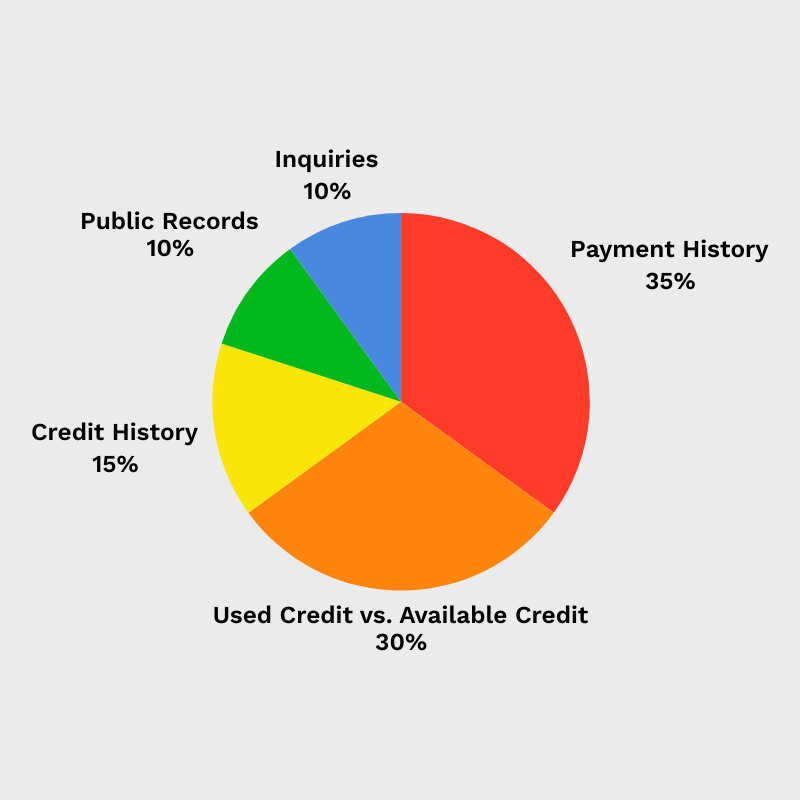

There are five main factors involved in calculating a credit score:

1️⃣ Payment history (35%):

Information on how current credit has been repaid. This would include if any payments were late or not paid in full. Details would be available for credit cards, lines of credit, installment loans, auto loans, student loans, finance company loans, home equity loans, and any mortgages. If any payments were late, the scoring model would take into consideration how late the payment was, how much was owed, and how recently the payment was missed.

2️⃣ Used Credit vs Available Credit (30%):

This would take into consideration how much of the total available credit is being used, as well as any other revolving lines of credit. This is also often referred to as credit utilization. A good rule of thumb is to keep is to keep your utilization at ~75% of the total limit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit (i.e. credit cards or lines of credit).

3️⃣ Length of Credit History (15%):

This section provides information on how long each credit account has been in existence. Generally speaking, creditors like to see that credit has been handled properly over a period of time.

4️⃣ Any Public Records (10%):

Any bankruptcy, consumer proposal, collection, or derogatory public record would be noted and may have a negative impact on credit score.

5️⃣ Inquiries (10%):

Each time a credit file is accessed, the request for info is logged on file as an inquiry. Only a significant number of recent inquiries, in combination with other warning signals on the credit file should lead to a decline in credit score.

WHAT IS A CREDIT SCORE?

A credit score is a three digit number designed to predict the likelihood that an individual will pay their bills as agreed upon. It is a tool available for financial institutions to determine your creditworthiness. In Canada, there are two companies that provide credit adjudication, Equifax & TransUnion.

Consumer facing scores and lender facing scores are often different as they are taking into consideration different modeling data. Don't be surprised if they vary.

CAN I FIX MY SCORE IF IT IS LOW?

There are many things one can do to help improve their credit score:

- If there are errors on your report, we can assist with having them investigated and revised.

- Ensure all payments are up to date and made in full.

- Ensure all revolving credit is below 75% of the limit.

- If there are substantial credit concerns, we have partners who specialize in fixing & strengthening credit.

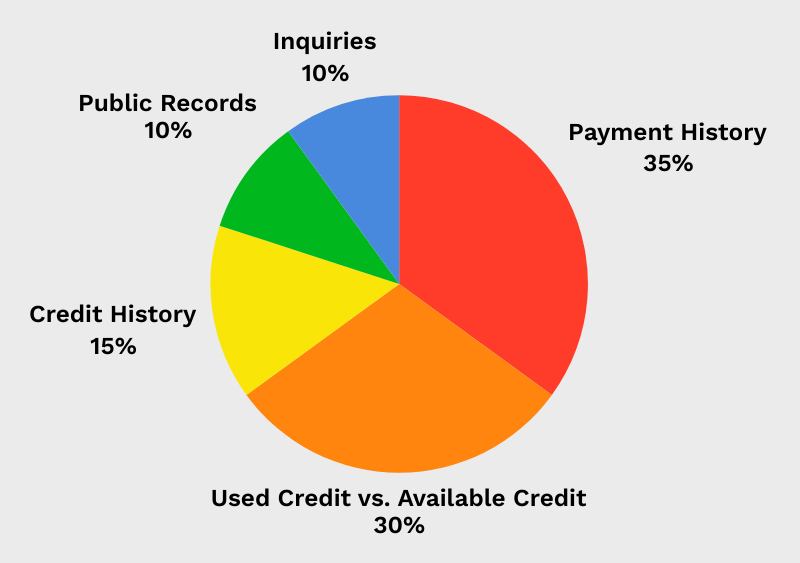

WHAT FACTORS ARE INVOLVED IN CALCULATING A CREDIT SCORE?

There are five main factors involved in calculating a credit score:

1️⃣ Payment history (35%):

Information on how current credit has been repaid. This would include if any payments were late or not paid in full. Details would be available for credit cards, lines of credit, installment loans, auto loans, student loans, finance company loans, home equity loans, and any mortgages. If any payments were late, the scoring model would take into consideration how late the payment was, how much was owed, and how recently the payment was missed.

2️⃣ Used Credit vs Available Credit (30%):

This would take into consideration how much of the total available credit is being used, as well as any other revolving lines of credit. This is also often referred to as credit utilization. A good rule of thumb is to keep is to keep your utilization at ~75% of the total limit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit (i.e. credit cards or lines of credit).

3️⃣ Length of Credit History (15%):

This section provides information on how long each credit account has been in existence. Generally speaking, creditors like to see that credit has been handled properly over a period of time.

4️⃣ Any Public Records (10%):

Any bankruptcy, consumer proposal, collection, or derogatory public record would be noted and may have a negative impact on credit score.

5️⃣ Inquiries (10%):

Each time a credit file is accessed, the request for info is logged on file as an inquiry. Only a significant number of recent inquiries, in combination with other warning signals on the credit file should lead to a decline in credit score.